Introducing Alto: Get Paid to Borrow

Forget rented liquidity. Alto introduces a new economic model where user rewards are captured to build a permanent, self-sustaining treasury.

The State of Stablecoins

Over the last two years, the stablecoin market has expanded at an unprecedented rate. Tether’s financial performance has demonstrated that stablecoins can be one of the most profitable sectors in crypto.

In a landscape dominated by centralized stablecoins backed by inaccessible assets with third-party risks, Alto introduces DUSD (Decentralized USD). DUSD is backed by a basket of high-quality, decentralized assets, currently including ETH, ETH LSTs, and tBTC, with support for additional high-quality assets to be added over time.

We’ve come a long way since the early cryptopunk ethos, and it’s often said that nobody cares about decentralization until it’s too late. As institutions finally enter the arena, the “infinite garden” is now crowded. Competition is fierce, and all these new protocols face the same challenge: liquidity.

The Liquidity Mining Trap

The simplest way to source liquidity has been through liquidity mining. But this is a trap. This approach depends on continuous incentives that are inherently limited. Once incentives end, liquidity vanishes. Market makers and farmers take their piece of the pie, and the protocol is left with a "down only" governance token.

The second, critical problem with this "rented liquidity" is that it’s not there when you need it. During periods of market stress, it can flee in a matter of blocks, leaving the protocol with no liquidity to bootstrap a recovery.

Market & Opportunity

That liquidity trap is the core reason most "governance tokens" fail to hold value. They are designed as inflationary expenses, not as a claim on the protocol's success.

This creates a massive disconnect in the market: Tether, the issuer of USDT, runs the most successful stablecoin business in the market, yet it has no public token through which investors can gain exposure to its profitability. This has fostered the pursuit of other ways to invest in the stablecoin sector. Coinbase’s COIN stock offers limited exposure to USDC, and TRON’s ecosystem is generally overlooked by crypto-native investors. Ethena’s ENA token became one of the few viable options, proving the immense market appetite for any token that provides exposure to this space.

This leaves a clear, massive gap: the market is missing a decentralized protocol with an economic engine built for long-term, sustainable value accrual.

Ethena’s ENA token recently proved the immense appetite for any token that captures value from stablecoin mechanics, rather than just inflating it away.

This is precisely where ALTO is positioned.

As Guy, Ethena’s founder, pointed out, there are four main use cases for on-chain stablecoins:

- Store of Value

- Payments

- Credit

- Perpetuals

Many protocols fail by spreading themselves too thin. ALTO’s primary goal is to tackle the on-chain DeFi credit market, a ~$25B sector at current valuations.

We are not just building another stablecoin; we are building a self-sustaining economic system designed to capture the value it generates. We are positioned to take on this challenge thanks to several advantages:

- Modern Protocol Design: Built to avoid the known pitfalls and incentive misalignments of first-generation protocols

- Self-Sustaining Liquidity: A focus on building Protocol-Owned Liquidity (POL) removes reliance on finite, external incentives

- Competitive Interest Rates: The protocol's efficiency is designed to offer highly competitive rates

- Sustainable Tokenomics: The token model is structured to align the long-term incentives of participants with the health of the protocol

This philosophy dictates our economics. ALTO’s revenue is directly linked to the market cap of its stablecoin, DUSD. A stable and growing DUSD market cap, in turn, requires the one thing we refuse to rent: deep, reliable liquidity.

The Thesis: Stop Renting, Start Owning

Rather than renting liquidity, ALTO's central strategy is to build and own its liquidity by creating a treasury of Protocol-Owned Liquidity (POL).

This treasury is funded through the protocol's unique rewards system. Instead of simple token emissions, users are given the right to purchase ALTO tokens at a discount. The payments from these sales are captured by the treasury, creating a self-sustaining foundation for growth.

Liquidity is king, and whoever controls it sets the rules of the game.

Alto is clear-eyed about what that transition requires. A stablecoin that is merely a tool for its own protocol will fail. To be successful, it must become a core asset for the wider DeFi ecosystem. This means it must have:

- Deep, reliable markets so users can move in and out of other major assets with low slippage

- Genuine utility that extends beyond our own platform, allowing it to be used for trading, lending, and payments across other dApps

- Broad accessibility through on/off-ramps that connect it to the fiat world

- Portability to move freely across chains, not be locked into a single ecosystem

Our launch strategy is focused on building this foundation. At launch, Alto will focus on deep liquidity, through our POL engine, and clear utility, through our credit market. As adoption grows, accessibility and portability will follow, allowing DUSD to extend into new ecosystems and real-world contexts.

The Product: Money Talks

A new protocol faces several points of friction: Smart contract risk, UX friction, and the time required to learn a new system. But the fifth bullet is always the most decisive: Is there money to be made?

The answer is simple: money talks. Users will come if the yields significantly exceed the sweet spot.

Getting paid to borrow sounds appealing, and it is. While other protocols must give away their governance tokens as emissions, ALTO aligns incentives differently. The protocol builds POL, and users gain leveraged exposure to the most demanded assets while getting paid to do so.

Here’s how the product works

- Mint DUSD: Users can supply ETH, ETH LSTs, or tBTC as collateral to mint new DUSD. These assets directly back the stablecoin and generate revenue for ALTO stakers

- Lend DUSD: Users can lend DUSD to Borrow Markets, earning interest from borrowers while helping the protocol manage systemic risk

- Borrow DUSD: In isolated Borrow Markets, users can borrow existing DUSD against other supported collateral types. The interest paid by these borrowers flows to lenders

- Leverage: Users can increase exposure through Flash Leverage, which uses a single flash loan to reach the desired leverage level in one transaction

The Engine: ARO (ALTO Reward Options)

ARO is central to our thesis: it aligns token distribution with user participation and funds our POL. Tokens are distributed only through the exercise of AROs, so the protocol has zero emissions before any exercise takes place1.

Who is eligible for ARO?

- Lenders: Users supplying DUSD to Borrow Markets

- Borrowers: Users borrowing DUSD from Borrow Markets (receive the highest rewards)

How do AROs work?

- Discounted ALTO: ARO gives users the right to purchase ALTO tokens from the ARO Emission Pool at a discounted price (their "strike price"). This price is based on a periodically updated Reference Price and a variable Discount

- Out of the Money: Users must compare their strike price with the ALTO spot price. If the strike price is higher than the market price, the ARO is "out of the money," and the user will likely not exercise

- Expiration Date: AROs are not indefinite. Each reward has an expiration time, after which the user forfeits the right to purchase

All payments from exercised rewards are transferred to the Alto Treasury.

Example 1: In the Money

- ALTO Spot Price: $2

- Your Strike Price: $1.5

- You exercise your 100 AROs, paying $150 to the Treasury. You receive 100 ALTO (worth $200) for a $50 net profit

- The Alto Treasury captures $150 in new POL

Example 2: Out of the Money

- ALTO Spot Price: $1

- Your Strike Price: $1.5

- You do not exercise; it's cheaper to buy on the market. The ARO expires worthless

- Inflation decreases. No new ALTO tokens are released, which reduces downward pressure and creates a natural price floor

The Value Capture: Staking and Flywheel

This entire system is designed to be self-sustaining. Alto’s primary sources of revenue are the opening fees from both Mint and Borrow Markets, the interest generated in Mint Markets, and the liquidation fees. 100% of this revenue flows directly to ALTO stakers, while in Borrow Markets, lenders receive all borrower interest.

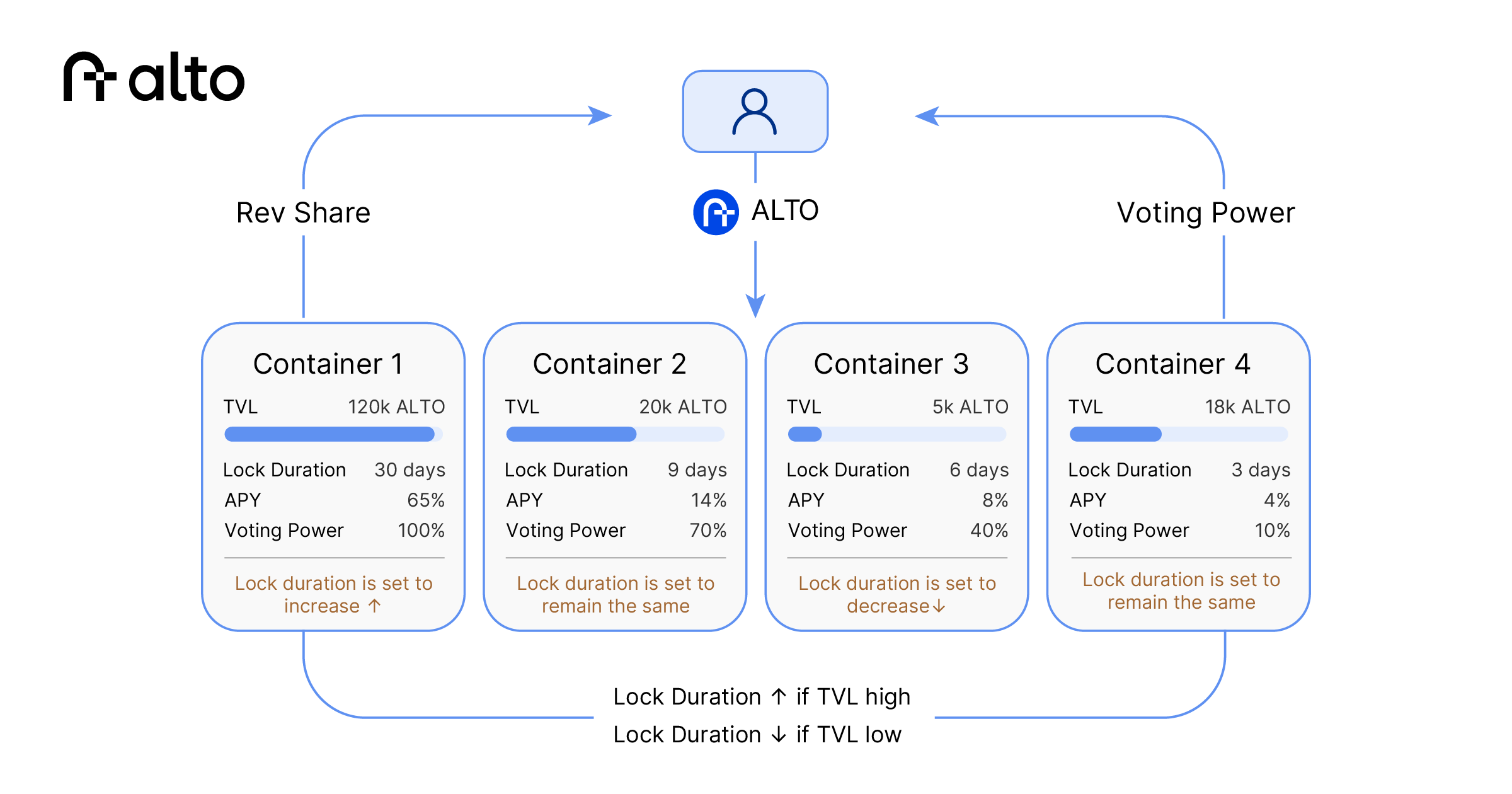

The staking mechanism itself adapts dynamically to market demand. You can stake ALTO in different Staking Containers, each with distinct lock-up periods. The longer you lock your ALTO, the closer you get to 1:1 voting power and a higher profit share. You can also receive greater ARO discounts when you choose to lock ALTO during an ARO exercise.

These locking times adjust. If many users stake in a specific container, the system recognizes high demand and increases that container’s lock duration in the next epoch. Conversely, if demand is low, the lock time decreases.

This creates the flywheel:

- More users lend or borrow DUSD → drives higher DUSD activity

- Higher DUSD activity → generates more protocol revenue

- More revenue → increases ALTO staking yields

- Higher yields → attract more ALTO staking and more ARO exercises

- More ARO exercises → grow the Treasury’s POL and deepen liquidity

- Deeper liquidity → strengthens DUSD stability and demand

- Stronger stability and demand → attract more users

Note: The protocol will launch in a guarded state, allowing parameters to remain adjustable during the initial rollout. This approach ensures that key variables — such as reward rates, collateral factors, and liquidity thresholds — can be fine-tuned based on observed market conditions and community feedback before full decentralization.

Footnotes

-

Aside from the initial allocations required for vesting, the airdrop, the LBP, and the Uniswap market setup. ↩